Steps to take when your identity has been compromised

Ask yourself: How did the fraudster get my information?

Knowing how the identity thief accessed your information will inform you on what information you need to protect, and what passwords you need to change. Did they get your information through a data breach? Did they access your information through a scam phone call or email? Or did they install malware on your device? If you're not sure, that's ok! We advise you follow the below steps to be extra cautious.

If you think they accessed your phone or computer

If you're worried they did install malware on your phone, but you're not sure, cybersecurity companies like McAfee and Norton have free options for malware scanners and virus removal tools.

If they got access to your online accounts, immediately change your passwords and contact your credit union or bank. There are several free Online Password Keepers that provide you with encrypted ways to keep track of your new passwords as you update them. This will help you protect your accounts if they have accessed your information.

If they haven't accessed your devices or online accounts but do have your personal information, now is still a good time to change your passwords. Regularly changing your passwords is a way to ensure your privacy is protected.

If they have your social security number or other personally identifying information

Check your credit reports for recent inquiries or accounts opened in your name. Dispute any fraudulent inquiries with the credit bureaus and contact the financial institutions that ran the inquiry. Keep an eye on your tax return and contact the IRS, as the scammer may file a tax return to receive your refund if you're eligible for one.

If they stole your wallet

Follow the steps above regarding your social security number. Cancel any of the cards that you had in your wallet and get new ones ordered. Review your recent transactions to dispute any fraudulent activity. Contact your state's DMV about procuring a new ID.

Freeze or place a fraud alert on your credit report

A fraud alert requires a creditor to verify your identity when you apply for new credit, while a credit freeze limits any access to your credit report without your authorization. Frequently one of the first moves by fraudsters is to open credit cards, new accounts, or loans in your name. Contact the three major credit bureaus and place a fraud alert on your credit report. This alert will prevent lenders from opening credit in your name without your authorization.

Here are the websites of the credit bureaus and their phone numbers:

Experian

1 888-397-3742

Equifax

1 888-378-4329

Transunion

1 800-680-7289

Close accounts that have been compromised

What you can do to avoid identity theft:

Review Your Statements

Checking your statements when they arrive is a surefire way to make sure your accounts are not compromised. You can access your statements anytime, anywhere by enrolling in eStatements.

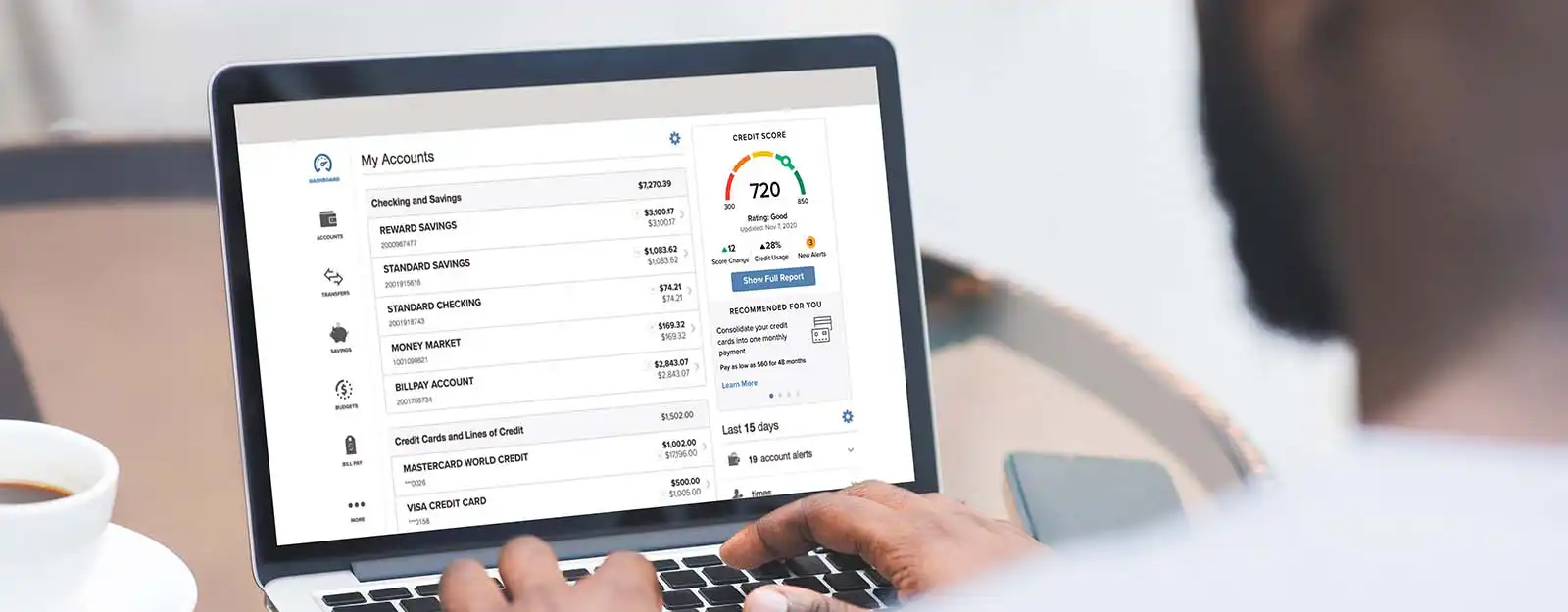

Set up Account Alerts in Digital Banking

You can customize Account Alerts to let you know when your account has a transaction that exceeds a certain amount, your account drops below a certain balance, you receive a direct deposit, and more.

Make sure your contact information is up to date

Having up-to-date contact information on your account makes it easy for us to contact you when we notice something is wrong with your account.

Use Biometrics and Multifactor Authentication

Enrolling in any and all biometric identification programs will make your account more secure. We have VoiceID, which adds an extra layer of security to our phone system when you call in. Multifactor authentication is also another way to protect your accounts. When you enroll in multifactor authentication, you'll be prompted to provide a code from an account or phone number only you have access to, ensuring the right person is accessing your account.