Extended Insurance Account

Secure Your Business Cash with up to $10M* in Protection

Extended Insurance

Extended Insurance

Your business funds are protected up to $10M* through our NCUA-insured partner network, all managed through one simple account.

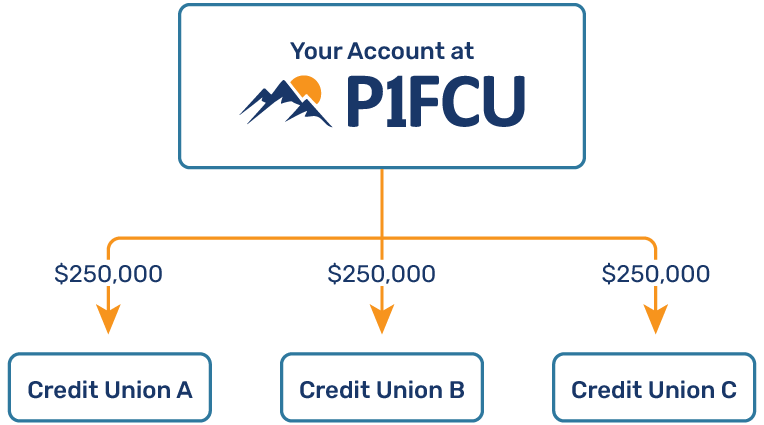

Auto-Sweep

Auto-Sweep

The system distributes funds across partner institutions.

Competitive Rates

Competitive Rates

Earn interest on your full balance while protecting your deposits.

How the Account Works

The best part? You still manage it all through one account. There's no juggling multiple logins or tracking different statements. Everything happens behind the scenes, so your funds stay safe and accessible, and they work for you without the extra hassle.

Have Questions? We've Got Answers!

Whether you are looking for more information on share insurance, or are curious about membership, loans, or digital banking, our FAQs have you covered. They're a quick, easy way to find what you need when you need it.

Check Out Our FAQs

Cash Management

Payable, receivable, and fraud mitigation services to manage your business's finances that much easier.

*Insurance provided through program credit unions (subject to certain conditions).

Funds participating in the P1FCU Extended Insurance Account are deposited into accounts at participating credit unions, which are insured by the National Credit Union Association (NCUA) for up to $250,000 for each category of legal ownership, including any other balances you may hold directly or through other intermediaries, including broker-dealers. The total amount of NCUA insurance for your account depends on the number of credit unions in the program. If the balance in your account is greater than the NCUA insurance coverage in the program, any excess funds will not be insured. Please read the Program Terms and Conditions carefully before depositing money into the program and for other important customer disclosures and information. To assure your NCUA coverage, please regularly review credit unions in which your funds have been deposited, and notify P1FCU immediately if you do not want to allocate funds to a particular credit union or credit unions.