How to Protect Yourself from Fraud

|

|

Fraud Blogs

Fraud is on the rise, and scammers keep getting sneakier. In our latest episode of Making Sense of Money, we sat down with Detective Tyler Crane from the Lewiston Police Department to talk about the fraud they have seen, how to spot red flags, and why trusting your gut could save you thousands of dollars.

It's stressful and upsetting to find out that a scammer or identity thief has access to your personal information. It can be hard to know where to start to protect your identity once your information has been stolen. Follow this checklist to make sure you have your bases covered.

Read More

How Do Scammers Get So Much Information About Me?

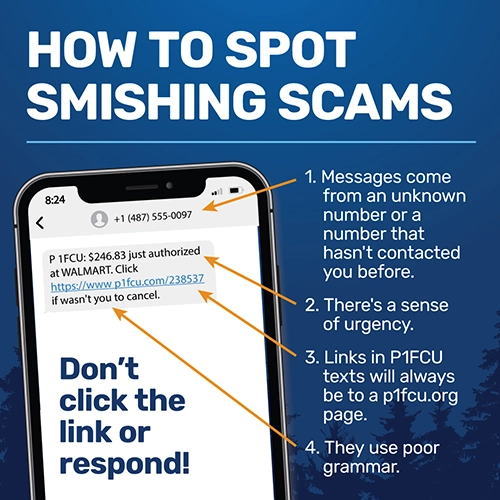

- Be wary of suspicious emails or text messages, especially those asking for personal information or urgent requests.

- Never click on links or open attachments from unknown sources.

- Always verify the authenticity of a website before entering any sensitive information.

- Use strong and unique passwords for all your online accounts, and change them regularly.

Check Before You Click

Before clicking on any link, take a moment to hover over it with your mouse cursor. This simple action reveals the actual URL at the bottom corner of your browser, allowing you to verify if it's directing you to a trustworthy site. Additionally, look out for misspellings or subtle character swaps in the URL, which are common tactics used by fraudsters to create misleading websites.

Be Wary of Calls and Texts

- Avoid using information about you that's easy to guess, like your birthday or name

- Use a mix of uppercase and lowercase letters, numbers, and special characters

- Start using passphrases instead of passwords

- Enable Multi-Factor Authentication

The Strength of Passphrases

Instead of passwords, consider using passphrases: a series of words that create a phrase or sentence. Not only are they easier to remember, but when you use a unique combination of words, they become incredibly difficult for hackers to guess. For added security, try incorporating uncommon words or inside jokes that only you would understand. Try to make them at least 14 characters long.Maximizing Security with Multi-Factor Authentication (MFA) When Available

MFA requires users to provide two or more verification factors to gain access to an online account, making it much harder for unauthorized users to access your account. This could include something you know (like a password), something you have (such as a mobile device), or something you are (like a fingerprint). By implementing MFA, even if a hacker manages to decipher your password, the chances of them having your additional authentication factor are very slim.Use a Trusted Password Manager

Keeping track of numerous passwords can feel overwhelming, but that is where using a reliable and trusted password manager comes into play. A password manager acts as a digital vault where you can store all your passwords under one master password. This means you only need to remember one complex password while having easy access to all others. Look for password managers that have strong encryption and have MFA available.

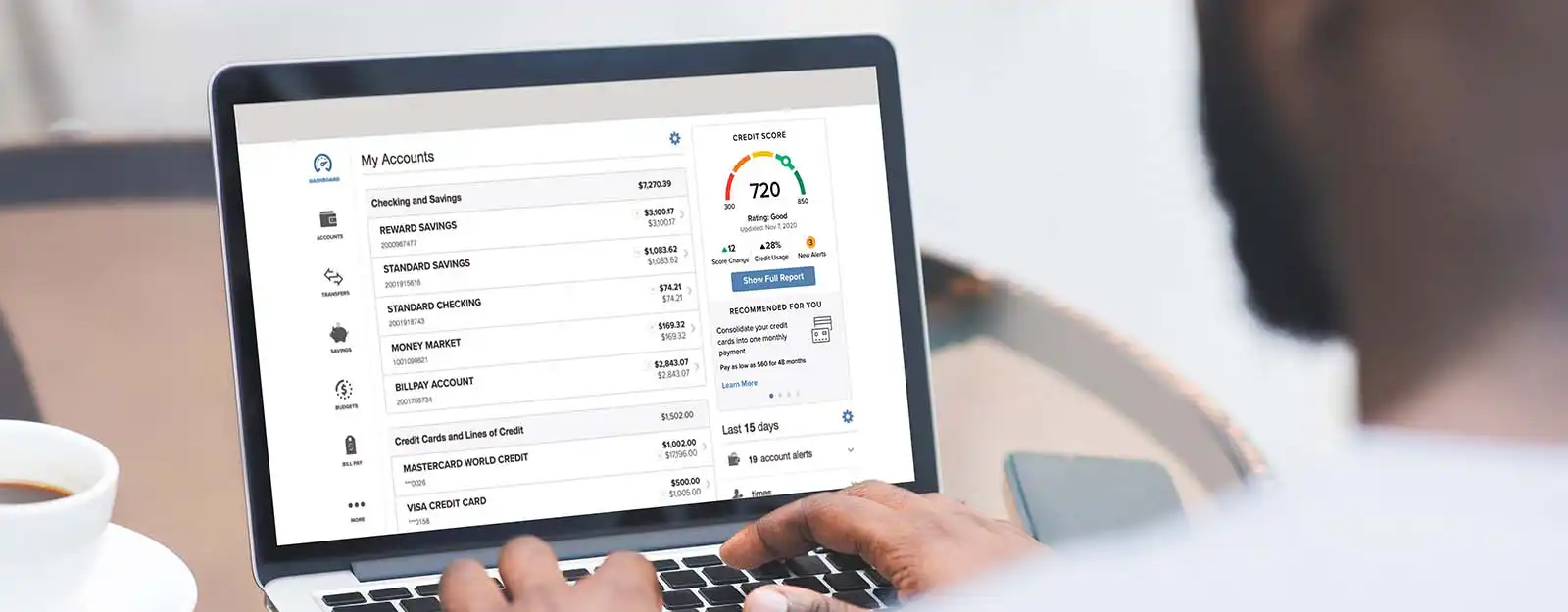

- Keeping track of your accounts online will prevent fraudulent activity from occurring without your knowledge

- Check your credit score online with Credit Score

- Set up Account Alerts to be notified when certain things happen on your account

Keep track in Digital Banking

Using Digital Banking to keep track of your account offers unparalleled convenience and real-time access to your financial information. This not only allows you to monitor transactions as they happen but also enables you to act quickly and address any discrepancies or unauthorized activities, thereby enhancing your financial security. Plus, the ease of managing your finances from anywhere, at any time, helps streamline your personal budgeting and financial planning processes.

Monitoring your credit score

Monitoring your credit score plays a crucial role in identity theft and fraud prevention. A sudden drop in your score or unfamiliar activities on your credit report can be the first signs that someone else is using your personal information for fraudulent purposes. By keeping a close watch, you're not just protecting your credit health; you're actively safeguarding your identity. P1FCU members can keep track of their credit score in their Digital Banking with Credit Score.

Account Alerts

Set up Account Alerts so that you can be notified via text or email for nearly any activity on your account. You can set alerts for when your account goes below or above a certain balance to get notifications for transactions, daily balance alerts, and much more.

- Enroll in eStatements to prevent your information from getting lost or stolen in the mail

- Securely destroy documents that have your personal information on them

eStatements

Enrolling in eStatements instead of traditional paper statements significantly enhances your information security. By eliminating the physical mailing process, you reduce the risk of your sensitive financial information being intercepted or stolen from your mailbox. Furthermore, eStatements are stored securely in your online banking account, protected by advanced encryption.

Smart Disposal Strategies for Sensitive Information

Shredding paperwork before disposal is crucial. Whether it’s a bill, bank statement, or personal letter, shredding ensures that the information doesn't fall into the wrong hands. If digital data is involved, make sure to wipe or physically destroy the hard drive.

- A lot of hackers and fraudsters gain access to your computer and phone because those devices are running on outdated, unprotected software.

- Antivirus and Malware protection are a great way to protect your computer.

Antivirus Software

Installing reliable antivirus software is like having a vigilant security guard for your computer. It actively seeks out and neutralizes potential threats before they can cause harm, including viruses, malware, and spyware. This small step can significantly reduce your risk of falling victim to cybercrime, keeping your personal information safe and secure.

Keeping Your Devices Up to Date

Keeping your software up to date is like adding an extra layer of armor in the fight against hackers and fraudsters. These updates often include critical patches for security vulnerabilities that, if left unaddressed, could be exploited by malicious parties. It’s a simple yet effective way to ensure your digital environment remains as impenetrable as possible.

Stay Safe from QR Code Scams

What is QR Code Fraud?

Scammers now use QR codes to trick individuals into providing sensitive information like debit card details, passwords, or other personal data. These fraudulent codes may direct you to fake websites designed to steal your information or even install malware on your device.

How QR Code Scams Work:

Fake Letters or Notices: Scammers send letters or messages with QR codes, claiming they're related to your account, property, or an urgent bill.

Phishing Websites: Scanning the code takes you to a fake website that looks legitimate, where you're asked to enter your debit card or personal information.

Tampered QR Codes: Fraudsters may replace legitimate QR codes with fake ones on posters, ATMs, or public notices.

How to Stay Safe:

Verify Before Scanning:

Only scan QR codes from trusted sources. Contact the sender directly if you're unsure about a code in an email, letter, or poster.

Avoid Providing Sensitive Information:

Never enter your debit card, password, or personal information on a website accessed through a QR code unless you're sure it's legitimate.

Manually Enter Websites:

If a QR code leads you to a website, type the web address into your browser instead of scanning the code.

Use Security Apps:

Use a QR code scanner app with built-in security to preview links before visiting them.

What to Do If You've Scanned a Fraudulent QR Code:

Act Fast: If you suspect a scam, contact us through a secure communication channel. Our secure channels are found here.

Change Your Passwords: If the website you visited requested login credentials, update your passwords immediately.

Monitor Your Account: Regularly check for unusual activity and report it immediately.

|

Fraud Tips to Remember:

If you're not sure about a message or an email, verify its validity by contacting us.

|