January 2026 Basecamp Newsletter

When you think about a credit union, you may think about everyday banking such as checking and savings accounts, loans, transactions, digital banking, and friendly customer service. What you may not think about is the advocacy work happening behind the scenes to protect and strengthen those services.

On this episode of Making Sense of Money, we sat down with Jordan, the Assistant Vice President of Grassroots Engagement at GoWest. GoWest is a credit union association that represents credit unions across six western states. He gives us insight on how credit union advocacy works and why it matters.

What is Credit Union Advocacy?

Credit union advocacy, to put it simply, is storytelling. “Advocacy is looking at the work that credit unions do and ensuring that we go out and tell that story,” Jordan explained.

In his role, Jordan focuses on advocating for credit unions by telling their stories to others. He speaks with legislators on behalf of credit unions and champions the value that they have. GoWest focuses on making sure that credit unions have a voice when laws and regulations are being discussed at both state and federal levels. With changes in legislation, and new lawmakers stepping in, education is vital.

“Many legislators are learning the job of being a legislator,” Jordan said. “Credit unions need to be at the table explaining who they are, who they serve, and how they’re different in the financial services marketplace.”

Why Advocacy is Important

Cryptocurrency has become especially appealing to scammers because it is difficult to trace and allows funds to move instantly across multiple channels and wallets. “It’s what we call pseudo-anonymous, not having to identify themselves with where they’re putting the money," Erickson said. For those who may not fully understand how crypto works, these scams can be more convincing and harder to navigate.

Because scammers often operate overseas, it makes it even more difficult for law enforcement to track or prosecute them. Even with specialized tools, there are still many obstacles they face when it comes to this type of fraud. With the wallet addresses rarely revealing who owns them and the speed of how quickly funds are transferred, investigators have a very short window to follow the money.

I'm sure you're wondering, what exactly is credit union advocacy? Click below to learn more.

Delivering Holiday Meals Throughout the NW

Throughout November, we collected nominations from members to provide meals to families in need. During the week of Christmas, we delivered 163 special holiday meals with the help of our team and community partners.

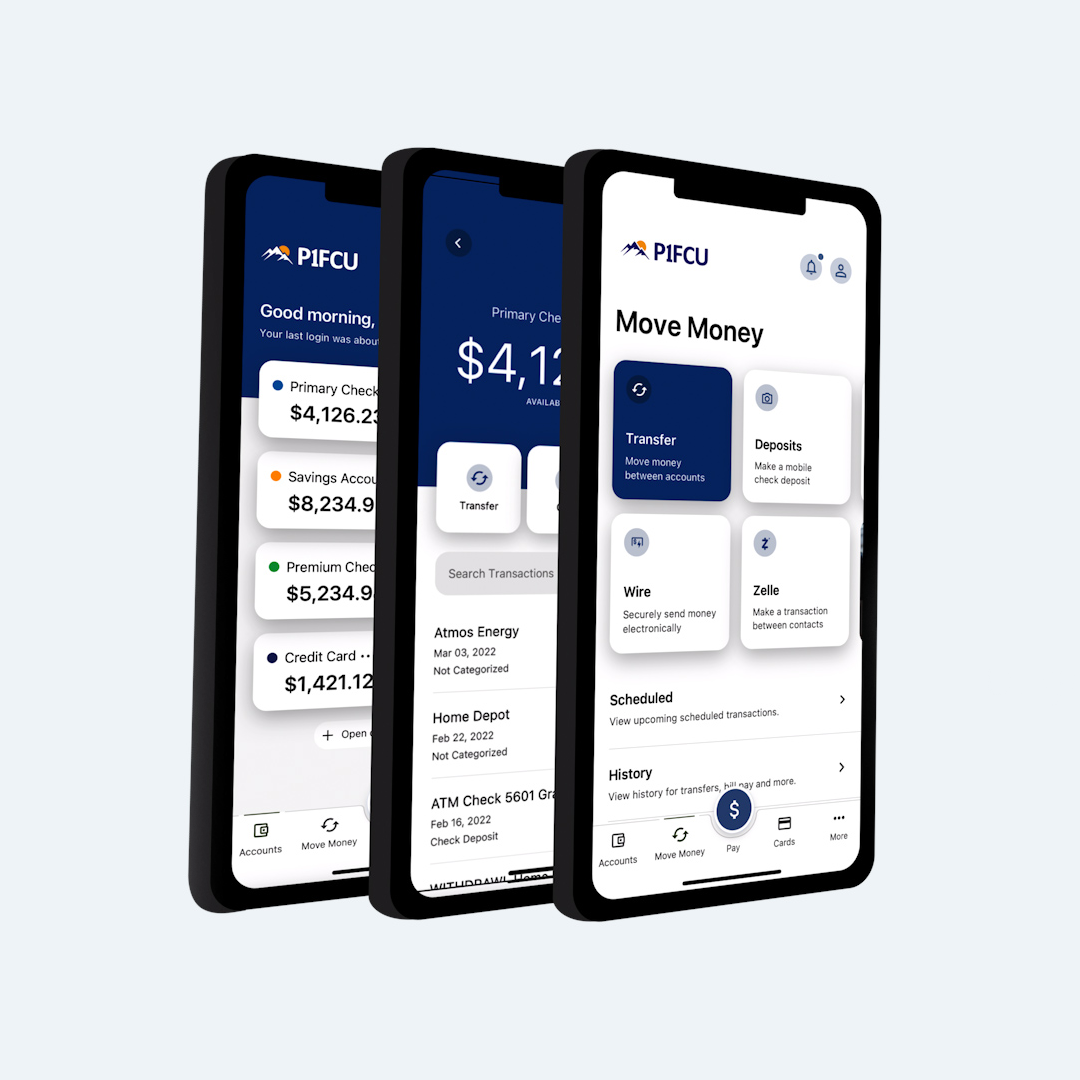

A New Experience is Coming Soon

We're upgrading our Digital Banking to bring you a cleaner design, smarter tools, and more control. Managing your money feels easier, faster, and more intuitive. Soon you’ll enjoy a modern, seamless platform with intuitive tools, improved mobile access, and enhanced security.

Identity Theft Warning Signs and Prevention Tips

Identity theft remains one of the most common and damaging forms of financial fraud. This happens when someone steals your personal information and uses it without your permission for their own financial gain.

Protecting financial well-being is a top priority. In the blog linked below, we’ll explain what identity theft is, how stolen information is used, signs to watch out for, and steps to take if you believe your identity has been compromised.

Protect Yourself from Identity Theft