Our routing number is 323173313.

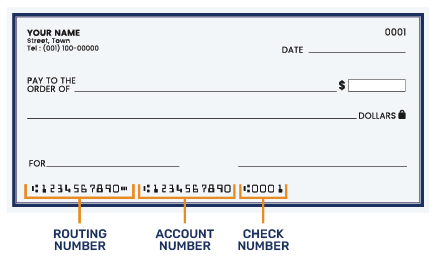

A routing number can be found at the bottom portion of your checks. You can find this number on the bottom of your checks.

You can find your Account Number (sometimes also called a MICR or Direct Deposit Auto Payment Number) through our Digital Banking.

- Log in to Digital Banking

- Select an account

- Click the Details & Settings tab. There you can find P1FCU's routing number.

You can find your account number (sometimes also called a MICR or Direct Deposit Auto Payment Number) through our Digital Banking.

- Log in to Digital Banking

- Select the account you need

- Click the Details & Settings button. Your account number will be listed

You can start your application for a new account here. When you open your account, you will need to fund your savings account with $35. Then, you will be able to open any additional accounts you may need.

You can check your account balance in the following ways:

- Log in to Digital Banking to see your account balances listed on the homepage

- Log in to the Mobile App to see your account balances listed on the home screen

- Call us at (208) 746-8900 and ask our Digital Assistant what your account balance is. If you haven't set up your voice banking profile with her yet, you'll need to verify your identity and create a PIN.

Your account balance shows the total amount of funds in your account. However, transactions like debit card purchases don't always clear your account immediately, so your actual account balance may be lower than what is shown.

Your available balance shows the account balance minus any pending transactions or holds. This balance shows how much you have available to withdraw or spend. While this balance generally reflects all pending transactions or holds, there may still be items that are not reflected so it's important to monitor all of your account transactions to avoid overdrafts or service charges.

There could be several reasons why your check bounced when there are funds in the account.

Since each situation is unique, contact us or stop by a branch for assistance with your check.

There are several reasons a check can clear for the wrong amount. The most common reason is due to the written amount not matching the numerical amount on the check. Since each situation is unique, contact us or stop by a branch for assistance with check errors.

You can use the NCUA Share Insurance Calculator to estimate your coverage level based on the open accounts that you have.

Please contact the person or company that wrote the check to alert them of the issue. This issue typically occurs when the checking account from which the funds were being withdrawn does not contain sufficient funds to cover the check. There may also be a return check fee applied to your account.

You can add a new joint owner by visiting your closest branch or contacting us to speaking with a representative. Your new joint owner will need the following information:

- Their government issued ID

- Their Social Security Number

- Their address and other contact information

Once we have all the required information, all the account owners will need to sign a new Member Account Agreement.

We offer Traditional, Roth, Simplified Employee Pension, and Coverdell Education Savings IRSs.

To open your IRA, contact us or visit your closest branch.

P1FCU does not offer a Health Savings Account at this time.

We offer an Idaho Medical Savings Account (MSA) for Idaho Residents, but it is not the same as a Health Savings Account. For more information from the State of Idaho, visit What is an Idaho Medical Savings Account?

It’s easy — Zelle® is already available within the P1FCU mobile app under the left hand menu! Open our app, select Send Money with Zelle®, and follow a few simple steps to enroll with Zelle® today.

Don't see the option? Contact us for more information.

You and your financial institution are the only ones who can view your account balances.

If you suspect your accounts have been compromised, contact us immediately so we can assist you.

Explore our FAQs for quick answers to your questions about P1FCU.

Back to FAQ Topics