Truth in Savings Disclosure Ascend Checking Account

RATE INFORMATION

The dividend rate and annual percentage yield may change at any time. We may change the dividend rate for your account as determined by the credit union.

To earn dividends, you must:

- Enroll in e-statements

- Complete a minimum of 20 posted debit card swipes per month (ATM transactions excluded)

- Make a monthly direct deposit of over $250

For any month where the account does not meet the qualification requirements, the account will not earn dividends.

COMPOUNDING AND CREDITING

Dividends will be compounded every month. Dividends will be credited to your account every month.

DIVIDEND PERIOD

For this account type, the dividend period is monthly, for example, the beginning date of the first dividend period of the calendar year is January 1, and the ending date of such dividend period is January 31. All other dividend periods follow this same pattern of dates. The dividend declaration date is the last day of the dividend period, and for the example above is January 31. If you close your account before dividends are paid, you will not receive the accrued dividends.

MINIMUM BALANCE REQUIREMENTS

There is no minimum balance requirement to maintain this account.

AVERAGE DAILY BALANCE COMPUTATION METHOD

Dividends are calculated by the average daily balance method which applies a periodic rate to the average daily balance in the account for the period.

The average daily balance is calculated by adding the balance in the account for each day of the period and dividing that figure by the number of days in the period. The period we use is the monthly statement cycle.

ACCRUAL OF DIVIDENDS ON NONCASH DEPOSITS

Dividends will begin to accrue on the business day you place noncash items (for example, checks) into your account.

TRANSACTION LIMITATIONS

No transaction limitations apply to this account unless otherwise stated in the Common Features section.

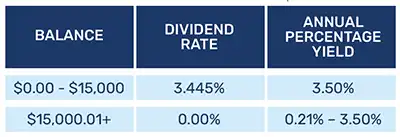

ASCEND CHECKING DIVIDEND RATE

Effective 03/01/2023

To download the Truth in Savings Disclosure Ascend Checking Account, click the button below.

Your savings are federally insured to at least $250,000 and backed by the full faith and credit of the United States Government, National Credit Union Administration, a U.S. Government Agency. Insured by NCUA.