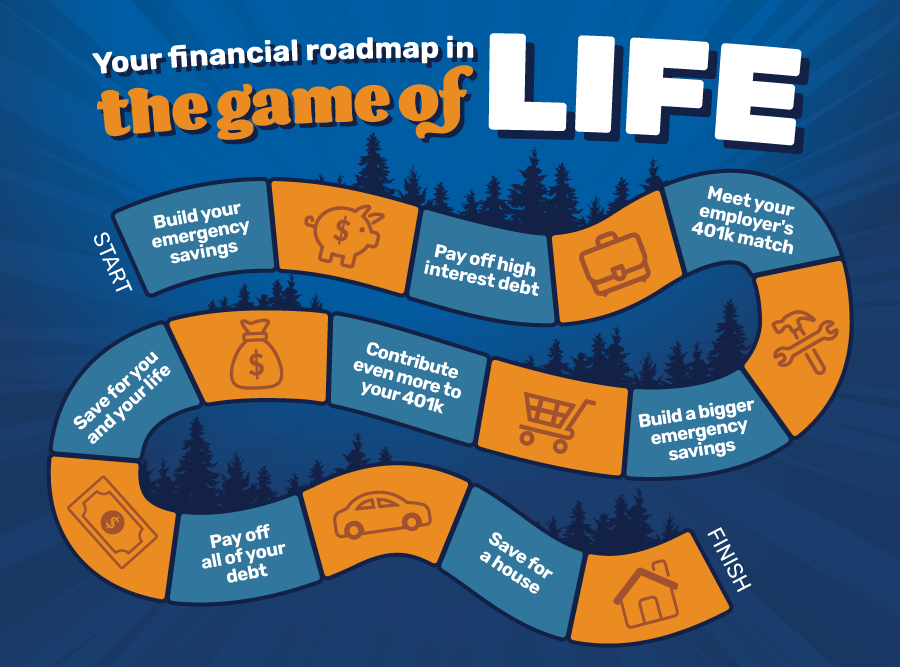

Your financial roadmap in the game of life.

by: holli casto

by: holli casto

vp of training and development

Published 4/15/2024

Sometimes, life can feel like it's passing us by so quickly that it's easy to get caught up in the present that we forget to plan for the future. While we're all for living in and enjoying the present, doing a little bit of planning for your future self will make a big difference for you down the road.

That's where setting goals like the ones listed below will save you down the line. Prioritizing things like your emergency savings and paying off high-interest debt, will set you up for success.

These are some fundamental goals we suggest everyone prioritize to help you secure your financial future.

Build your emergency savings.

According to a 2024 Bankrate study on emergency savings, most Americans wouldn't pay for an unexpected $1,000 expense, like an emergency room visit or car repair, out of their savings but put it on a credit card. That's to say, if you don't have much, if anything, in your emergency savings, you're not the only one.

Building your emergency savings should be your #1 priority to avoid going into or getting deeper into debt. We suggest getting started by opening a separate savings account for emergency savings. Next, make saving at least three months' worth of expenses a priority.

Your emergency savings is for both unexpected expenses, which can show up as things like vehicle repairs, or even an unexpected loss of income. When you spend from your emergency savings, rebuilding it should move back up to the top of your priority list.

Paying off high-interest debt.

Once you've built up three months of expenses in your emergency savings, your next goal should be to pay off high-interest debt like credit card debt and payday loans. This debt is the hardest to get out from under and the most costly. Dedicating any extra cash you have to pay it off early will save you a lot in interest payments in the long run.

If you have multiple loans or credit cards, you may want to research consolidating your debt into a personal loan. You could also look into moving your credit cards onto a low or no-interest balance transfer credit card.

Paying off this type of debt takes time and dedication, which can be discouraging at first. That said, paying off debt is similar to the law of inertia. An item in motion will stay in motion, and the more you make payments toward your debt, the faster it will be paid off. Furthermore, paying off this debt will free up the most room in your budget to achieve more of your goals moving forward.

Meet your employer's 401k match.

Once you've paid off your high-interest debt, your next priority is saving for retirement. Specifically, make sure you're meeting your employer's match for your 401k if they have one. Saving for retirement is extremely important to your financial well-being. The money you save when you're younger plays a more important role than what you save later on.

Even if you anticipate earning more later in life, which will be a bigger contribution, the money you save early will make a bigger difference. A lot of employers offer a match to your 401k. At a minimum, try to meet this 401k match so that you're not leaving money on the table.

Building a bigger emergency savings.

Once you've established your emergency savings, paid off your high-interest debt, and started saving for retirement, then your next priority should to be to save even more in your emergency savings. Set a goal of having at least six months of expenses in your emergency savings account. This will make you even more well-prepared for what life may throw your way.

This way, if you have to pull some cash out to cover an expense, it will not deplete your entire emergency savings. We also recommend keeping your emergency savings in a Money Market or High Yield Savings Account. Putting it in an account that earns interest but remains liquid, or easy to access, means that your money is going to work for you.

Contribute even more to your retirement.

Once you have at least six months of expenses saved up in your emergency savings, start contributing more to your retirement. We cannot stress enough how important contributing to your retirement is. Saving for retirement is a marathon, not a sprint.

The sooner you get started, the better. So, if you're able to increase your contribution, then we strongly suggest it. Shooting for 10% of your income is a great starting point, but if you can manage even more, go for it!

Choosing your own adventure

Once you've met those goals, you can start pursuing more goals as they align with your lifestyle. You can balance these to work toward them at the same time or work toward them one at a time. It depends on which is more important to you. Some of these goals can include:

Paying off debt

Aside from credit card debt, it's very normal for most of us to have debt. Between mortgages, student loans, and vehicle loans, there is a balance to walk between debt that helps you live your life and debt that is crippling you.

You may want to prioritize paying off your debt over these other goals if you have a high-interest rate or your minimum payments are eating up a large portion of your monthly income. You can also visit a lender to see how you can refinance your loans to better fit your budget.

Save for a home

If you currently rent, weigh the pros and cons of buying. Once you've checked all the above boxes, you may be in a place where buying a home may be in your sights. Even if you previously thought would never be able to afford a home, don't let that idea stop you from speaking with a loan officer. Homeownership is frequently much more feasible than many people realize.

Save for you and your life.

Whether you're saving for a special project like a home renovation, a special vacation, or even for your kids' college fund, setting a goal for these things is great idea. Not only does it give you a reference point for where you need to get to, the sense of gratification once you make it there is unmatched.

These are all some great goals to set for yourself, especially if you feel like you don't have much direction for your finances at the moment. That said, if you feel like these goals don't align with your life, by all means, set goals that meet your needs!

Your finances are personal to you, and there is no one-size-fits-all solution. Becoming familiar with your finances and what does and does not work for you is the most powerful thing you can do to become an active agent for success in your financial journey.